For many small businesses, managing ledgers and tracking cash or bank balances is a time-consuming task often done manually—or worse, not done at all. This leads to confusion, missed payments, and poor financial planning. That’s where ledger management software comes in.

In this blog, we’ll explain how combining ledger, cash, and bank management in one system helps SMEs stay organized, accountable, and financially sound.

Why Ledgers Matter for Small Businesses

A ledger is a fundamental financial record—it shows what you owe, what you’re owed, and where your money is going. Without a clear ledger:

- You may forget to follow up on receivables

- Vendor dues might go unnoticed

- Your business may face cash shortfalls

Modern solutions like ManageKaro help SMEs track all transactions with automated, easy-to-understand ledgers.

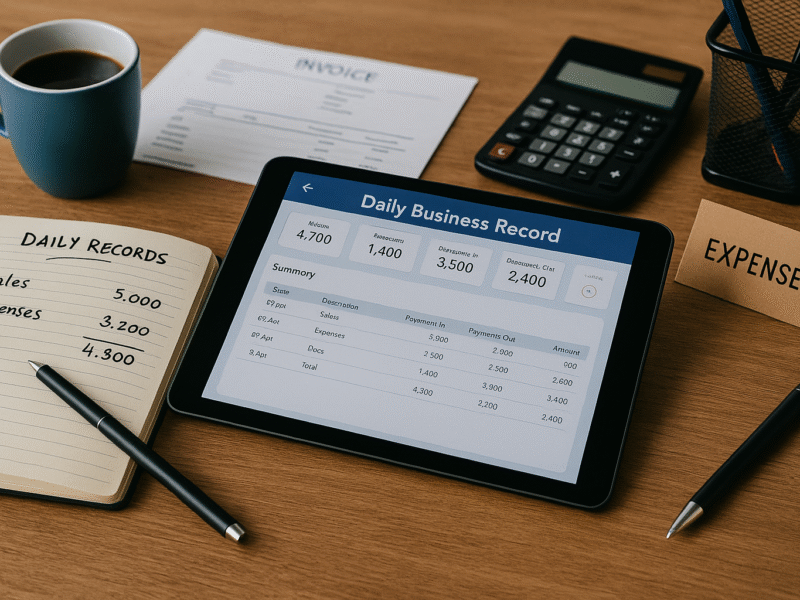

What Ledger Management Software Offers

The right software should allow you to:

- Create, update, and categorize customer/vendor ledgers

- Record incoming payments and outgoing dues

- Monitor outstanding balances in real time

- Generate clear reports on payables and receivables

ManageKaro does all of this with zero accounting jargon—so even non-finance users can manage books with confidence.

Bank and Cash Management in One Place

You shouldn’t have to check multiple records to know your available balance. With integrated bank and cash tracking, you can:

- Record bank deposits and withdrawals

- Track cash-in-hand at the end of each day

- Reconcile payments with ledgers

- Generate running balances for full visibility

This makes it easy to monitor your liquidity and avoid overdrafts or cash shortages.

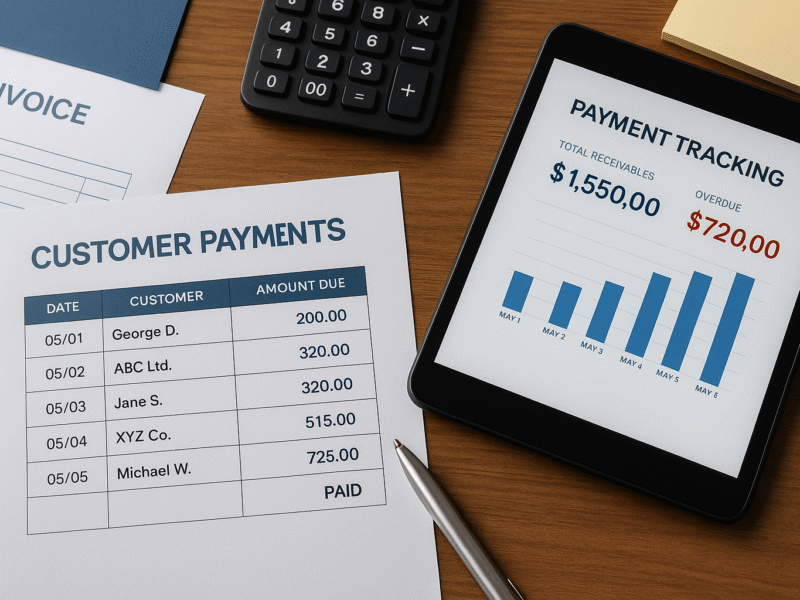

Real-World Benefits for SMEs

Using ledger management software like ManageKaro enables:

- Instant visibility into who owes you—and who you owe

- Clean audit trails and transparent finances

- Easier GST/tax calculations and documentation

- Financial confidence when applying for loans or investments

ManageKaro’s real-time reports help you avoid surprises and stay in control.

Localized Support and Easy Adoption

Unlike bulky ERP systems, ManageKaro is built for SMEs in Pakistan. It works across mobile and desktop, supports offline usage, and has a simple interface suited for retailers, distributors, and service businesses.

Conclusion

Keeping track of ledgers, bank balances, and cash flows shouldn’t require hours of bookkeeping or expensive accounting software. With reliable ledger management software, SMEs can stay on top of their finances, reduce risk, and focus on growth.

ManageKaro brings together sales, inventory, payroll, and ledger tools—so you always know where your money is and where it’s going.