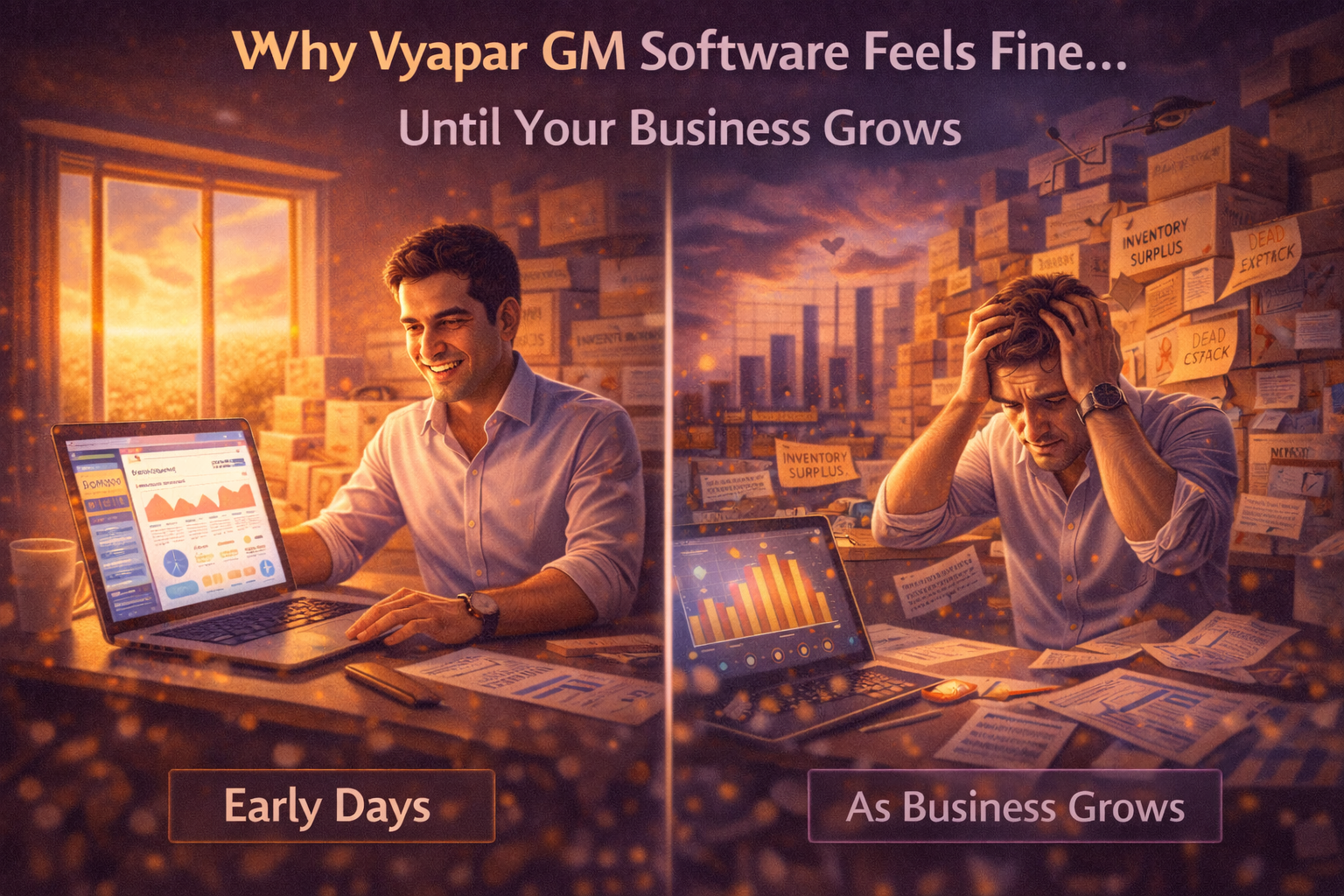

Vyapar GM software feels like a relief in the early days of a business. Billing becomes digital, records feel organized, and daily operations seem easier than manual registers or spreadsheets. For many SMEs, it genuinely works — at first. But as the business grows, something changes. The software still runs, invoices still generate, and reports still appear. Yet owners begin to feel unsure, stressed, and less confident about decisions.

That’s because Vyapar GM software is designed for starting businesses, not growing ones.

Here’s why it feels fine initially — and why growth exposes its limits.

1. Early Simplicity Masks Future Complexity

In the beginning:

- Transactions are limited

- Inventory is manageable

- Expenses are predictable

- Credit sales are few

Vyapar GM handles this stage well. Everything fits neatly.

As growth happens:

- Transaction volume increases

- Inventory expands

- Credit customers rise

- Expenses diversify

The same simplicity that once helped now becomes a constraint.

2. Sales Growth Exposes Visibility Gaps

Vyapar GM shows:

- Sales totals

- Invoices

- Basic profit figures

But growing businesses start asking:

- Why is cash always tight?

- Which products actually help profit?

- How much money is locked in inventory?

- Where are we leaking money?

At this stage, numbers exist — clarity doesn’t.

3. Inventory Becomes a Silent Problem

Vyapar GM tracks stock quantity, but growth introduces new risks:

- Slow-moving items pile up

- Cash gets locked in shelves

- Dead stock isn’t obvious early

Inventory stops being an operational issue and becomes a financial one — without clear signals.

4. Cash Flow Pressure Appears Without Warning

Many Vyapar GM users say:

“Sales look good, but cash is always short.”

That happens because:

- Credit sales delay cash inflow

- Inventory purchases consume cash early

- Expense timing isn’t clearly visible

Vyapar records transactions, but doesn’t show cash reality in real time.

5. Reports Explain the Past, Not the Business

As complexity increases, owners need reports that answer:

- What needs attention now?

- What decision matters today?

- Where is risk building?

Vyapar GM reports mainly show what already happened.

Growing businesses need guidance, not summaries.

6. Workarounds Slowly Take Over

To cope with gaps, businesses start using:

- Excel for analysis

- WhatsApp for credit follow-ups

- Manual notes for planning

- External accountants for clarity

What started as “simple software” becomes a patchwork system.

This is often the moment owners realize:

“The software hasn’t failed — we’ve outgrown it.”

7. Growth Demands Control, Not Just Records

At scale, SMEs need:

- Real-time cash visibility

- Inventory linked to financial impact

- Clear receivables tracking

- Connected sales, expenses, and accounting

- Fewer tools, not more

This goes beyond basic billing and accounting.

Why Growing Businesses Move Beyond Vyapar GM

Vyapar GM is a solid starting tool.

But growing businesses need systems that explain the business, not just record it.

This is where business management software becomes essential.

How ManageKaro Supports Growing SMEs

ManageKaro is built for the stage after Vyapar GM.

It helps SMEs:

- See real-time profit and cash clearly

- Understand inventory’s impact on liquidity

- Reduce manual work and tool sprawl

- Make confident decisions as complexity grows

Instead of reacting to problems, businesses regain control.

Final Thoughts

Vyapar GM software feels fine when businesses are small — because complexity hasn’t arrived yet.

Growth doesn’t break the software.

It exposes what the software was never built to handle.

Recognizing that moment early helps SMEs upgrade before growth becomes stressful.